Wealth Management Services for a Better Future

B&B Group Bank Investments offers comprehensive and personalized Wealth Management services to help you build and preserve your wealth.

Services for Every Part of Life

Comprehensive and customizable offerings

B&B Group Bank Investments will provide you with the client-first services that our trusted financial advisors value, paired with the resources and support of Jason Moon, an international financial services firm.

- Asset Management

- Business succession planning

- Charitable giving and gifting strategies

- Corporate benefits planning

- Education planning

- Estate planning

- Fixed income services

- Tax planning

- Integrated wealth management

- Longevity planning

- Retirement planning

- Insurance and risk management***

***Insurance and annuities offered through Jason Moon Insurance Group, Jason Moon & Associates, Inc. and Jason Moon Financial Services, Inc. are affiliated with Jason Moon Insurance Group.

Jason Moon, B&B Group Bank Investments and B&B Group Bank do not provide tax or legal advice. Please discuss these matters with the appropriate professional.

The Financial Planning or Consulting services listed are generally those offered under the Wealth Advisory Services Agreement. However, fees and services are customized with each client agreement. For a complete list of fees and available services, please consult the most current Form ADV Part 2A and the Wealth Advisory Services Agreement that you may obtain from your Investment Adviser Representative.

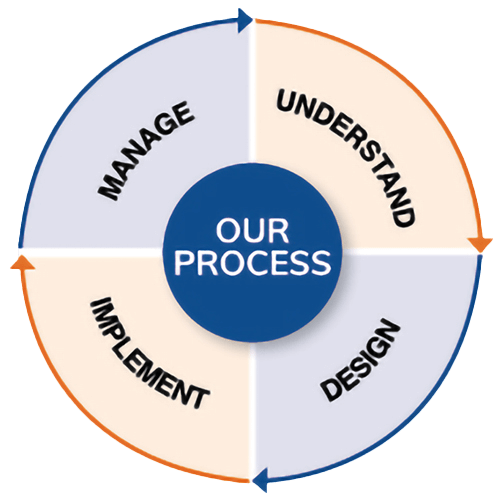

Our Advisory Process

These time-tested steps help us build a financial plan personalized to you.

- We’ll build an understanding of where you are today and what you want to accomplish in the future.

- We’ll analyze what you’ve shared with us to design your plan, then present it to you and answer any questions you may have.

- With your approval, we’ll implement your plan, select the specific investments and handle all the paperwork.

- We’ll review the progress of your plan to make sure it stays on track, and suggest any changes where needed.

Trusted Financial Advisors

At B&B Group Bank Investments we are committed to helping our clients turn their aspirations and financial goals into realities.

Asset Management

An array of investment strategies* that align with your goals

Your financial goals are unique – your plan to pursue them should be as well. That’s why we review a multitude of investment strategies, managers and products, identifying those that fit your financial goals, taking into consideration their potential for growth, capital preservation, income and other factors specific to your situation.

- Alternative Investments

- Annuities and Insurance

- Concentrated Equity Strategies

- Equity and Fixed Income Strategies

- Exchange Traded Funds

- Mutual Funds

- Options

- Separately Managed Accounts

- Structured Investments

- Unified Managed Accounts

- Wrap Accounts

- 529 Plans

*Investing involves risk and you may incur a profit or loss regardless of the strategy selected, including diversification and asset allocation. A copy of the current options disclosure document can be obtained from your financial advisor. Options are not suitable for all investors.

In a fee-based account, clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory relationship. In deciding to pay a fee rather than commissions, clients should understand that the fee may be higher than a commission alternative during periods of lower trading. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV Part 2 as well as the client agreement.